How real-time transaction monitoring improves AML compliance

Real-time transaction monitoring is now table stakes.

It improves data privacy, prevents transactions from getting "stuck in limbo," and reduces the manual workload of compliance teams.

The path to effective real-time monitoring requires skills from two traditionally separate spheres: Fraud and Anti-Money Laundering (AML) compliance.

Sardine’s platform offers real-time by default and batch, where you need it. That’s why fraud and compliance teamstrust our solutions.

The two worlds of financial services risk: fraud and AML

Historically, the realms of Fraud and AML in financial services have operated independently, driven by different needs and goals:

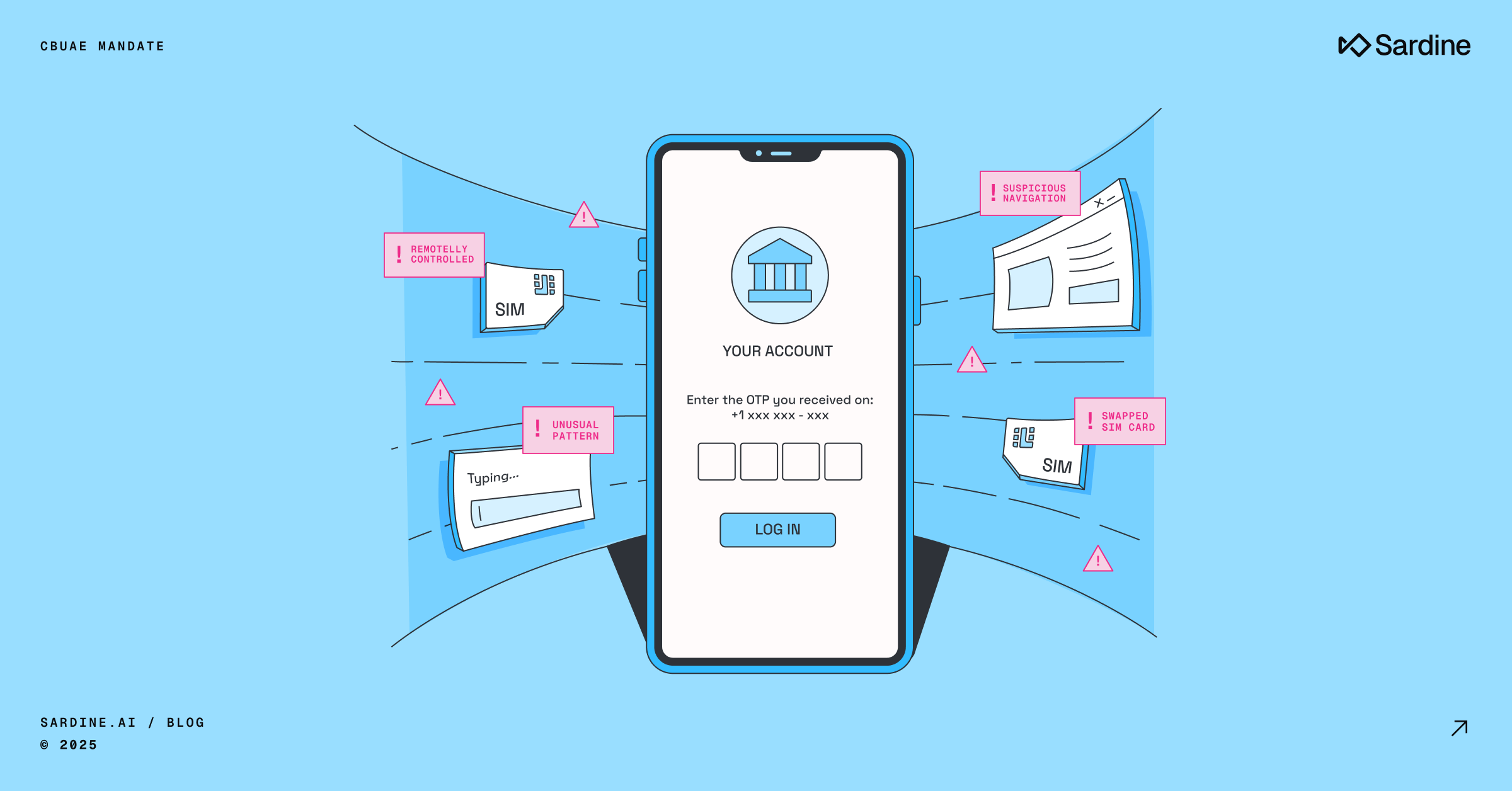

- Fraud Prevention: The primary goal here is real-time detection of potential fraudulent activities. Teams aim to detect and block any suspicious transaction or add an extra layer of verification before a transaction goes through.

- AML Compliance: In contrast, AML operations focus on identifying intricate patterns of transactions and activities that could suggest coordinated illicit action by crime rings or sanctioned entities. This often requires analyzing transactions retrospectively, which might take days or weeks.

The consequence is different processes, teams, and priorities, each operating in silos.

The benefits of integrated fraud and AML operations

At Sardine, we've seen that dismantling these silos creates a comprehensive risk management framework with two primary benefits: enhanced data privacy and more efficient handling of high-risk payments.

Data privacy

When potential fraud cases reach a certain threshold ($2000 in the US, for example), they must be escalated to compliance teams for Suspicious Activity Report (SAR) filing consideration. If these teams use different systems, this data transfer might happen through non-secure or non-privacy-preserving channels, such as emails.

Managing high-risk payments

Suppose a customer sends a large wire transfer exceeding a predefined transaction threshold, triggering additional due diligence and document collection for customer risk assessment.

- Without real-time transaction monitoring, the financial institution must receive the funds first. Then begins the cumbersome process of contacting the customer for supporting documentation. If the evidence provided falls short, the institution must initiate steps to offboard the customer. Meanwhile, the newly received wire transfer sits in limbo, causing both sender and receiver frustration due to the money being "lost in transit."

- With real-time transaction monitoring, the system can decline the incoming wire transfer and return the funds to the sender. Simultaneously, the compliance team can request additional supporting documentation, significantly reducing regulatory exposure and customer friction.

Real-time and batch: the best of both worlds

Despite the benefits of real-time monitoring, certain cases still require batch decisions. For instance, a rule that aggregates a user's transaction volumes for a calendar month and compares them to volumes across other users with similar risk profiles still needs complex SQL queries to compile transaction counts and volumes across various window functions.

However, an ideal system leverages real-time and batch capabilities, offering a more comprehensive, risk-based, and effective solution.

The imperative of real-time transaction monitoring

Real-time transaction monitoring isn't merely a nice-to-have. It's becoming a necessity for banks and fintechs that seek to improve their processes and maintain the highest standards of compliance and customer satisfaction.

While the Bank Secrecy Act (BSA) and FFIEC guidance do not require real-time monitoring, we’re seeing a notable shift in industry practice. Increasingly, banks and fintechs are sanctions risk, as part of a risk-based approach that reflects heightened examiner scrutiny and the operational realities of instant payments.

By integrating Fraud and AML operations, financial institutions can leverage the best of both worlds and take a significant leap towards combating financial crimes more effectively.

With Sardine, you can.

%20(1).png)