Less chargebacks, higher conversions

Approve more legitimate transactions while keeping your fraud rates low. Let Sardine take on the liability, handle all of the heavy lifting, and cover any costs.

Talk to Sardine

Schedule a 30-minute product demo with our experts.

By submitting this form, you agree that Sardine can contact you about our products and services. For more information, review our privacy policy.

Approve more customers, keep fraud rates low

Sardine identifies fraudulent transactions without blocking legitimate ones from going through. Our highly accurate risk scoring translates into fewer false positives and more revenue for your business.

Lower the operational cost of fraud prevention

Not only do we help reduce fraudulent chargebacks and improve conversions, we also partner closely with your team to reduce the overhead of fighting fraud.

Let us handle the fraud detection, risk decisioning, and dispute management on your behalf, so you can focus on growing your business.

Keep fraud costs predictable and stable

Variable fraud costs make forecasting difficult. Sardine’s guaranteed performance keeps your fraud costs predictable, while reducing your overall risk exposure.

How Chargeback Guarantee works

Merchant submits card transaction information to Sardine via API

Sardine evaluates the transaction in real-time and returns a guaranteed risk decision.

Merchant shares authorization and settlement feedback via API to optimize performance.

Sardine handles the dispute, evidence preparation, and merchant reimbursement.

Building blocks for fraud prevention

and regulatory compliance

Progressive KYC Onboarding

Support custom waterfall onboarding flows to intelligently route customers based on their initial risk level.

Real-time Bank

Account validation

Verify account ownership and risk level with the highest coverage across banks, credit unions, and fintechs.

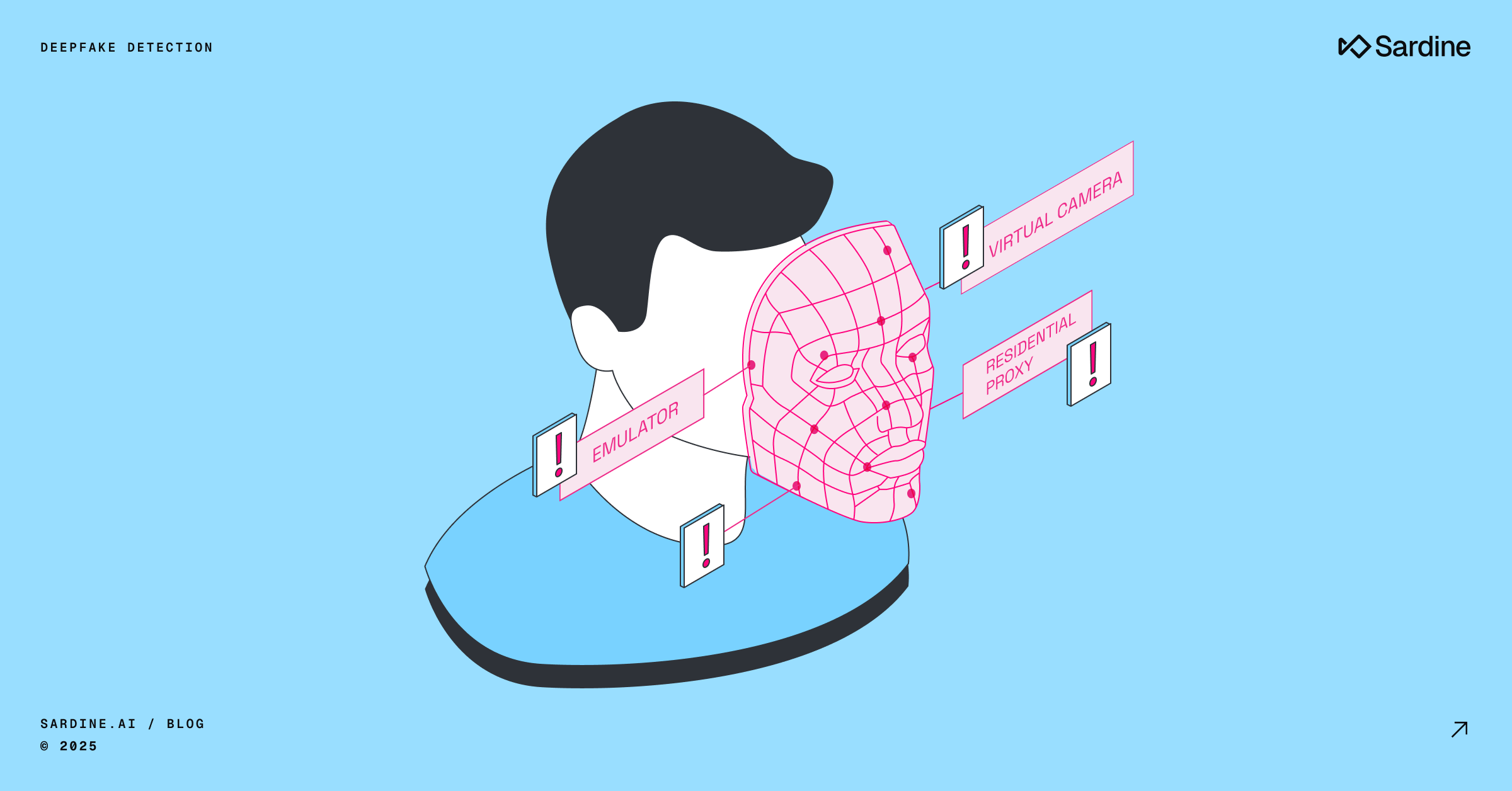

Device Intelligence and Behavior Biometrics

Detect high-risk users exhibiting suspicious mouse movements, or using VPNs, emulators, and remote access tools.

%20(1).png)