SardineX: Real-Time Fraud Data Consortium Uniting the Global Financial Industry

Today, we’re announcing the launch of SardineX, a 314b designated utility that unites banks, card networks, payment processors, fintechs, and decentralized finance platforms in the fight against fraud.

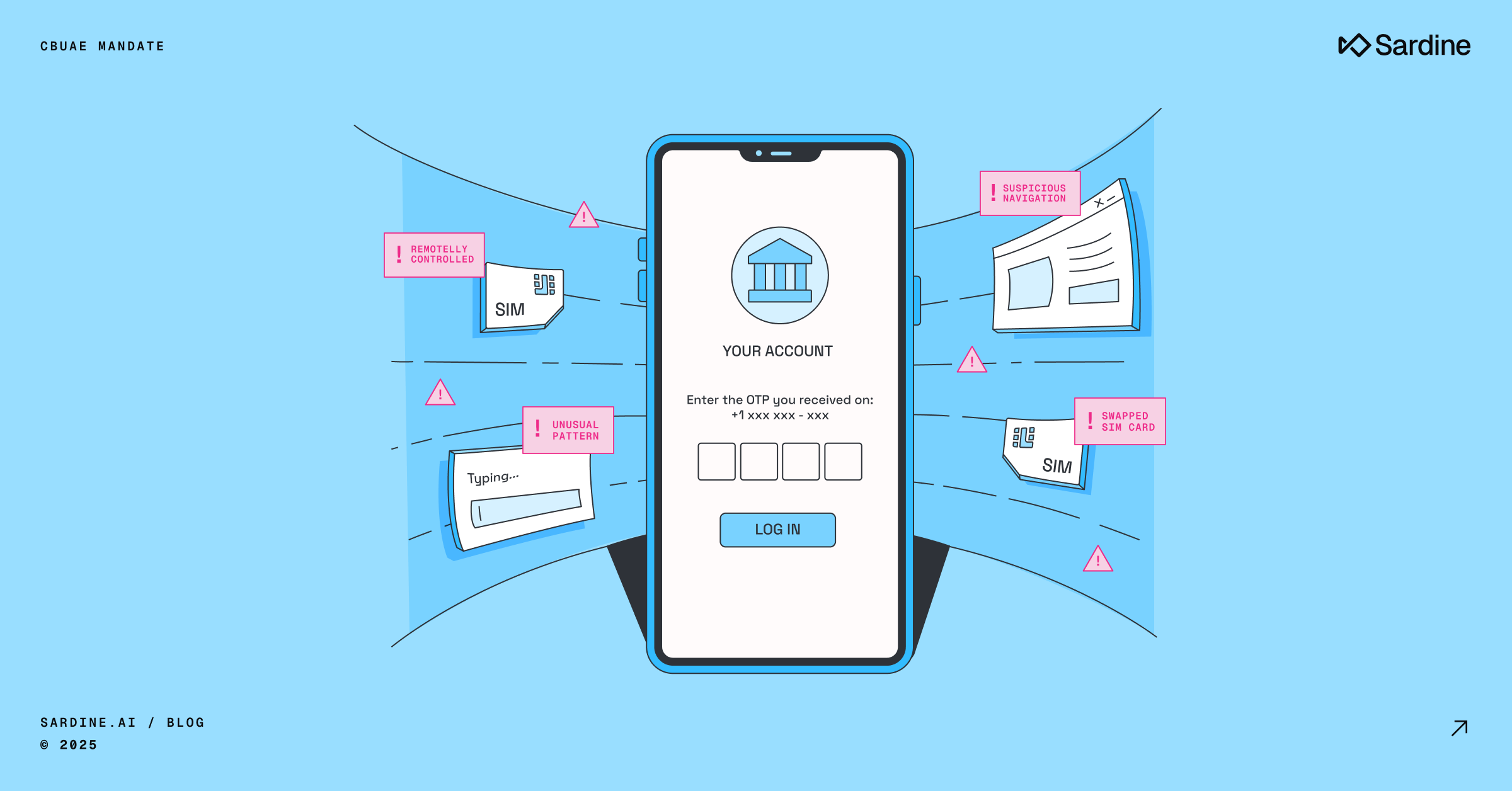

One of the most pressing challenges in fraud prevention is a visibility gap that exists among traditional banks, fintechs, and emerging payment rails. These entities largely operate in silos, each blind to the fraudulent activities taking place on other platforms. The massive increase in ACH-friendly fraud, authorized push payment (APP) fraud, and other scams has been largely due to this fragmented approach that leaves cracks exploited by fraudsters, money launderers and organized crime.

Consider the current scenario: a bank may notice unusual activity on a customer's account but lacks visibility into concurrent transactions happening on a fintech app or a crypto exchange. This siloed approach creates blind spots that fraudsters exploit.

With SardineX, this disjointed information is unified, ensuring fraud and transaction monitoring systems are working off the same, comprehensive picture. By pooling our knowledge and leveraging shared transaction data, we can identify fraudulent activities as they occur and prevent them from spreading across the global financial system.

How the SardineX Fraud Data Consortium Works

SardineX is designed to be a real-time fraud data sharing utility that leverages collective insights from a shared data pool to provide a holistic view of transactional risk. The shared data pool includes a wealth of information including risk scores, reputation levels, device fingerprints, behavioral biometrics, and more.

Members can then access these insights via an API for real-time fraud risk analysis and transaction feedback. All data shared within the consortium is anonymized to safeguard the privacy of all members. The consortium also operates under a strict legal framework to ensure that data sharing is compliant with all relevant privacy laws and regulations such as Gramm-Leach-Bliley Act and Section 314(b) of the USA PATRIOT Act.

Real-World Impact: Not a Hypothetical Scenario

Imagine a scenario where an individual's bank account starts showing unusual activity - frequent, large transactions are being made to a crypto exchange. Simultaneously, the same individual's fintech app reports multiple failed login attempts. In a traditional setup, these activities would be treated in isolation, with each institution unaware of the other's issues.

But with SardineX, these two financial entities can share anonymized risk data, spotting the pattern of fraudulent activity almost immediately. This rapid, unified response could prevent potential fraud before it becomes detrimental to the customer and financial institutions.

Founding Consortium Members

SardineX wouldn't be possible without the trust, commitment, and vision of our founding members. Major players in the financial world, including Visa, Airbase, Novo, Blockchain.com, Alloy Labs, Chesapeake Bank, iLEX Consulting Group, and Spring Labs have come together to support this initiative.

By pooling their knowledge and resources, they have helped to create a utility that benefits the entire financial ecosystem.

If you’re interested in testing out the consortium or becoming a founding member, we can make the API available for proof of concept (POC) arrangements and give you access for 90 to 180 days to score your ongoing transactions. Alternatively, you can send us 90 days of previous transaction activity and we’ll score those transactions against known results. Contact us to learn more.

Join the Fight Against Fraud

We invite banks, card networks, payment processors, fintechs, and emerging finance platforms to join SardineX. Membership is simple, based on participants being permissioned parties that can access relevant data under existing legal frameworks.

Participation in the consortium requires active involvement in the governing Working Group, which includes quarterly Working Group meetings where participants will work together to drive the development of the consortium’s product roadmap and discuss critical topics in risk management.

%20(1).png)