Account funding

Enable users to fund or top-up their digital wallets using their bank account. Make funds available for immediate use so customers can start transacting on your platform sooner.

Bill payment

Allow customers to make bill payments directly from their bank accounts. Payments are processed instantly. As fast as a card payment, without the network fees.

NFT checkout

Give customers a seamless way to purchase digital assets using their bank account. Convert more customers and offer higher transaction limits without hold times.

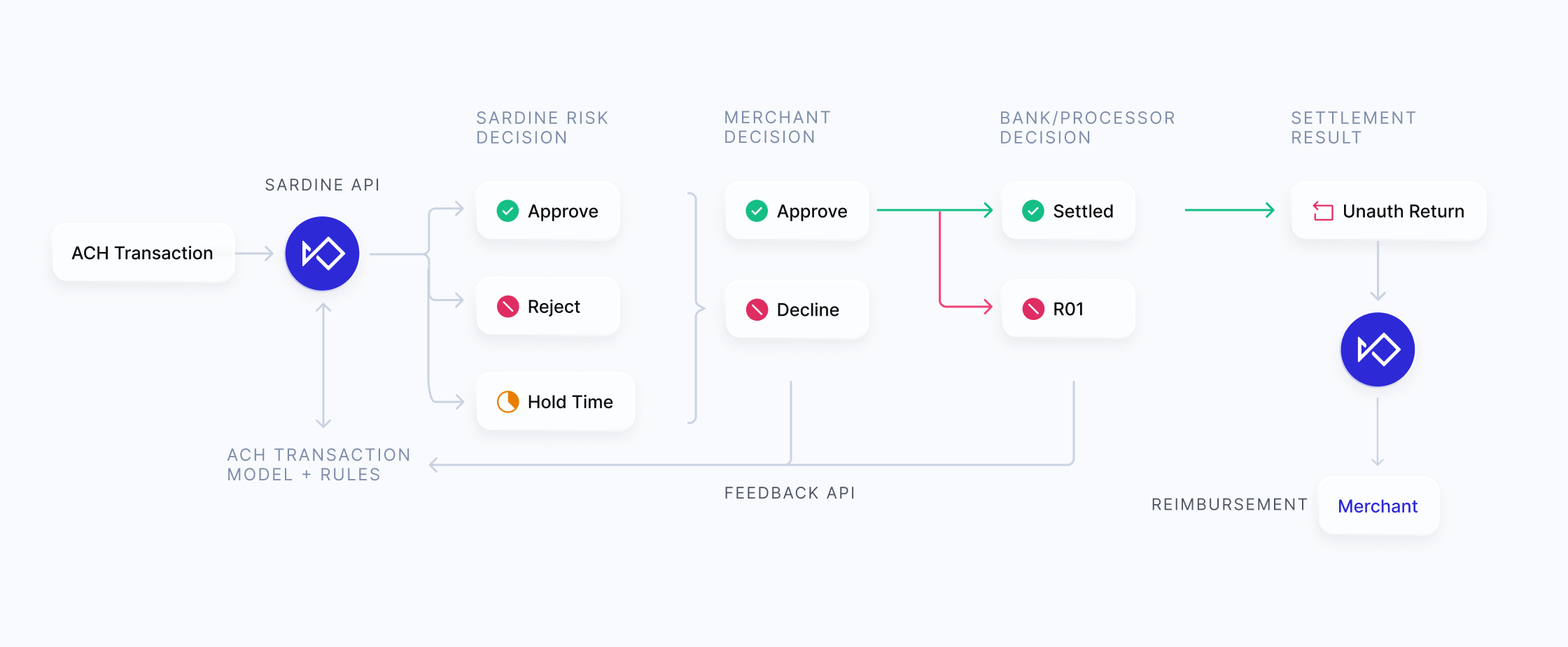

How Instant ACH works

Sardine evaluates risk in real-time to assign an instant limit and hold time for additional amounts.

Sardine processes the ACH transfer or bill payment.

Sardine pre-funds the approved limit and takes on the ACH settlement risk on your behalf.

Merchant shares authorization and settlement feedback via API to optimize performance.